When a policy comes up for renewal and it was on the AmPac payment plan, us at Angus-Miller will automatically transfer the client to the IFS payment plan for you. When you receive your client’s renewal policy from us you would also receive the client’s new IFS contract, legal wordings, and an introductory page stating when the payments will be taken from the client’s account and who they should contact if they have any questions about the roll-over.

You may keep a copy of the contract for your records and give the original contract to your client with the legal wordings and the introductory page. The contract is the client’s “payment schedule”, it shows the payment date, the number of payments and the payment amount.

Since Angus-Miller and IFS have a partnership in this venture, you do not need to have the renewal IFS contract signed because we still have their original signature in our office records.

An Angus-Miller underwriter will advise the broker of the additional premium. At that time if the insured would like to simply pay the additional premium in the office that is perfectly fine. If the insured would like to finance the additional premium the broker will access the clients account online and process the additional premium and send it to IFS to process.

Policies that are able to be financed with this Angus-Miller/ IFS partnership are:

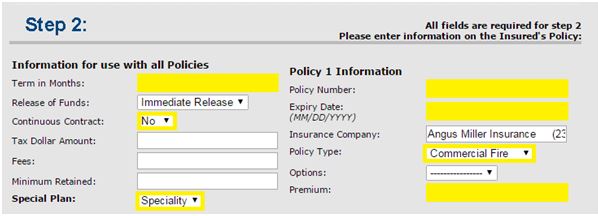

When you have a policy that you assume will be on a payment plan it is good to mention it to the commercial underwriter you are speaking to so they can tell you at what rate it will be financed; Specialty= 7% and Standard=3%.

The following are the steps to follow to successfully finance a policy through Angus-Miller and IFS:

1.Go to the Angus-Miller Website and click on the “Payment Plan” tab:

2. Click on the Link to be re-directed to the IFS Website:

2. Click on the Link to be re-directed to the IFS Website:

3. Type in your Broker Code and Password that would have been given to you either by Meagan Ouellette and Lynne Gerhardt or from your office manager:

4. Once you have successfully logged onto the IFS website you will click on the link near the bottom labeled Angus-Miller Financing, which will take you to the contract generator.

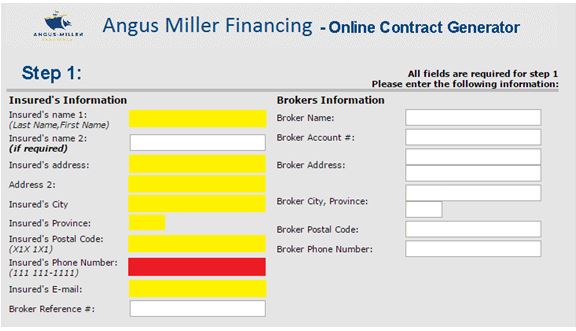

5. Filling out Step 1 on the Contract Generator:

6. Filling out Step 2 on the Contract Generator:

7. Fill out Step 3 if you are financing more than 1 policy on the same contract. It is filled out in the same way Step 2 was filled out.

8. If you wish to print a plant contract click on the small box beside “Print Blank Contract”. You can print the contract in either English or French by choosing from the “Contract Language” drop down menu.

9. When you are finished press the “Generate Contract for Printing” button.

10. Once the Contract is filled out and printed and the insured is happy with the payment amounts and down payment amount, have them sign under “Signature of Buyers”. If there are 2 named insured on the policy they both must sign the contract. The broker must sign as the “Authorized Representative”.

11. If the insured would like IFS to take their monthly payments from their bank account they will have to fill out and sign page 3 of the contract and attach a void cheque to the contract.

12. If the insured would like the down payment to be taken from their bank account, you will need to have them fill out the down payment form that can be found on the “Payment Plan” page on the website and also on the “Forms/Questionnaires” page on the website. If the insured wants to pay the down payment at the brokerage that is also acceptable.

13. When you are finished, scan and email the completed contract to helen@ifs-finance.com or fax toll free: 1(800) 453-5736.

14. Don’t forget to label the policy as Agency Bill in your records!

If you have any additional questions feel free to contact: